Fillable IRS Form 4868

Get NowFile for Extension with the 4868 Form Today!

Filing taxes can be a daunting task, but there are ways to make the process a little less stressful. One way is using the fillable version of the federal 4868 form. This form is used to request an extension of time to file your individual tax return. Here's how to obtain, fill in, and file the fillable version of the IRS 4868 form.

Obtain the Free Fillable 4868 PDF

- Go to the IRS website and search for "Form 4868."

- Click on the link for "Form 4868 (PDF)" to download the fillable PDF version of the document.

- Open the PDF in Adobe Acrobat or a similar program that can fill in PDF forms.

Rules to Fill in Form 4868 Online Appropriately

- Enter your name, address, and Social Security number in the appropriate spaces.

- Fill in your estimated tax liability for the year on line 4.

- Calculate your total payments and credits for the year on line 5.

- Subtract line 5 from line 4 to determine the amount of tax you owe on line 6.

- Enter any additional amount you are paying with the extension request on line 7.

- Calculate the total amount you owe on line 8.

- Sign and date the template.

File the Fillable 4868 Form Correctly

- Save a copy of the filled-in sample for your records.

- Submit the application electronically using the IRS e-file system or mail it to the appropriate address listed on the template.

- If mailing the PDF, be sure to use certified mail and request a return receipt to verify that the IRS received it.

Due date

The due date for the 4868 tax form is April 15th. If you cannot file your tax return by this date, you can request an automatic extension of time to file using Form 4868. The extension will give you an additional six months to file your tax return, making the new due date October 15th.

In conclusion, using the fillable version of the 4868 tax form can make requesting an extension of time to file your tax return a little easier. Just be sure to fill in the form appropriately, file it correctly, and meet the due date to avoid any penalties or interest charges.

Related Forms

-

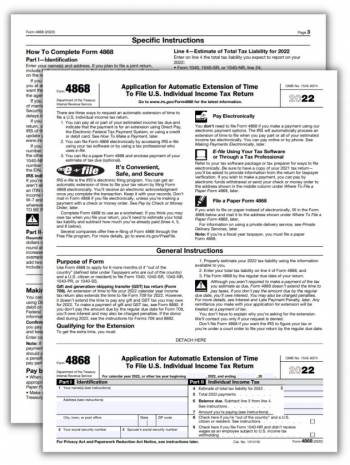

![image]() 4868 This is a document individuals and businesses use to request an extension on their tax return filing deadline. IRS tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from April 15th to October 15th. Filing for an extension using the application is straightforward and can be done online, by mail, or by phone. It's important to note that while an extension on filing is granted, any taxes owed must still be paid by the or... Fill Now

4868 This is a document individuals and businesses use to request an extension on their tax return filing deadline. IRS tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from April 15th to October 15th. Filing for an extension using the application is straightforward and can be done online, by mail, or by phone. It's important to note that while an extension on filing is granted, any taxes owed must still be paid by the or... Fill Now -

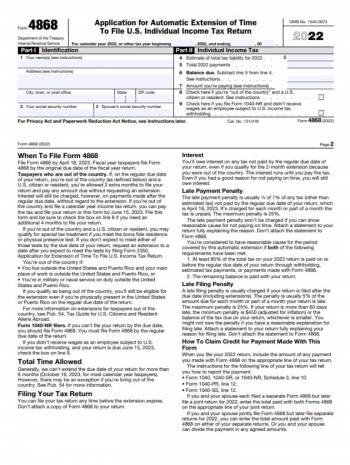

![image]() IRS Form 4868 Instructions for 2022 Hey there, taxpayers! Are you worried about missing the tax deadline? Or maybe you need more time to gather all the necessary information to file your return accurately? In that case, the IRS has got you covered with Form 4868. In this essay, we will explore the purpose of the form, its essential details, and common mistakes people make while completing it. IRS Form 4868 Purpose Firstly, let's talk about the form's purpose. Form 4868, also known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows taxpayers to request an extension of up to six months to file their income tax returns. The form's due date coincides with the regular tax filing deadline, which is typically April 15th. However, with Form 4868, taxpayers can push their deadline back to October 15th. Instruction to Fill Out the 4868 Form Now, let's dive into the essential details you need to pay attention to while working with Form 4868. Here are some key points to keep in mind: The application should be filed by the regular tax filing deadline, which is generally April 15th. The extension of time to file does not extend the time to pay any taxes due. Taxpayers are still required to estimate and pay their tax liability by the regular tax deadline. Failure to pay taxes owed by the regular deadline may result in penalties and interest. The document can be filed electronically or by mail. Taxpayers who are out of the country on the regular tax filing deadline may be eligible for an automatic two-month extension without filing Form 4868. Common Issues Lastly, let's discuss the most common mistakes people make when completing Form 4868 and how to avoid them. Here are some mistakes to watch out for: Forgetting to estimate and pay taxes owed by the regular tax deadline. Failing to sign and date the form. Providing incorrect or incomplete information, such as the taxpayer's Social Security number or extended tax year. Filing the extension application after the regular filing deadline without reasonable cause or approval from the IRS. Assuming that filing Form 4868 grants an extension to pay taxes owed. To avoid these mistakes, make sure to read the form's instructions carefully, double-check all the information provided, and file the document on time. If you're unsure about anything, seek help from a financial professional or the IRS. In conclusion, Form 4868 can be useful for taxpayers who need more time to file their income tax returns. By understanding the form's purpose, essential details, and common mistakes, taxpayers can ensure they file accurately and avoid penalties and interest. Remember, filing for an extension does not extend the time to pay taxes owed, so be sure to estimate and pay any taxes due by the original deadline. Fill Now

IRS Form 4868 Instructions for 2022 Hey there, taxpayers! Are you worried about missing the tax deadline? Or maybe you need more time to gather all the necessary information to file your return accurately? In that case, the IRS has got you covered with Form 4868. In this essay, we will explore the purpose of the form, its essential details, and common mistakes people make while completing it. IRS Form 4868 Purpose Firstly, let's talk about the form's purpose. Form 4868, also known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows taxpayers to request an extension of up to six months to file their income tax returns. The form's due date coincides with the regular tax filing deadline, which is typically April 15th. However, with Form 4868, taxpayers can push their deadline back to October 15th. Instruction to Fill Out the 4868 Form Now, let's dive into the essential details you need to pay attention to while working with Form 4868. Here are some key points to keep in mind: The application should be filed by the regular tax filing deadline, which is generally April 15th. The extension of time to file does not extend the time to pay any taxes due. Taxpayers are still required to estimate and pay their tax liability by the regular tax deadline. Failure to pay taxes owed by the regular deadline may result in penalties and interest. The document can be filed electronically or by mail. Taxpayers who are out of the country on the regular tax filing deadline may be eligible for an automatic two-month extension without filing Form 4868. Common Issues Lastly, let's discuss the most common mistakes people make when completing Form 4868 and how to avoid them. Here are some mistakes to watch out for: Forgetting to estimate and pay taxes owed by the regular tax deadline. Failing to sign and date the form. Providing incorrect or incomplete information, such as the taxpayer's Social Security number or extended tax year. Filing the extension application after the regular filing deadline without reasonable cause or approval from the IRS. Assuming that filing Form 4868 grants an extension to pay taxes owed. To avoid these mistakes, make sure to read the form's instructions carefully, double-check all the information provided, and file the document on time. If you're unsure about anything, seek help from a financial professional or the IRS. In conclusion, Form 4868 can be useful for taxpayers who need more time to file their income tax returns. By understanding the form's purpose, essential details, and common mistakes, taxpayers can ensure they file accurately and avoid penalties and interest. Remember, filing for an extension does not extend the time to pay taxes owed, so be sure to estimate and pay any taxes due by the original deadline. Fill Now -

![image]() Tax Form 4868 Example Are you one of those people who always wait until the last minute to file your taxes? Do you need more time to prepare your tax return? If so, then the tax form 4868 might be your best friend. In this article, we will discuss what Form 4868 is, who needs to file it, and how to file it. Terms to Use IRS Form 4868 Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, is a document that allows individuals to request an automatic extension of time to send their federal income tax returns. The individual will have an additional six months to file their tax return if approved. Form 4868 Target Audience Individuals who cannot submit their tax return by the due date, usually April 15th, can request an extension by filing federal form 4868. However, it is important to note that an extension of time to file does not extend the time to pay any taxes owed. Individuals must still estimate and pay any taxes owed by the original due date to avoid penalties and interest. Form 4868 Examples & Solutions While anyone can request an extension of time to send their tax return, certain situations may make it necessary or beneficial to do so. Here are a few examples: Natural disasters: If you live in an area that has been declared a federal disaster area, you may be eligible for an extension of time to file your tax return. For example, if you were affected by Hurricane Ida and live in one of the designated disaster areas, you may have until January 3, 2022, to send your tax return. Military service: If you are a military member serving in a combat zone, you may be eligible for a time extension to submit your declaration. You may have up to 180 days after you leave the combat zone to send your tax return and pay any taxes owed. Nonresident alien: If you are a nonresident alien who does not have a green card and do not meet the substantial presence test, you may need to file form 4868 to request an extension of time to submit your yearly declaration. This will give you an additional six months to meet the substantial presence test and file your annual declaration. File Federal Form 4868 Example Filing the document is relatively simple. You can file it electronically using tax software or through the IRS's Free File program. Alternatively, you can send a paper form by mail. If you are expecting a refund, there is no need to send form 4868, as the extension only applies to the time to file, not the time to receive a refund. Form 4868 can be a valuable tool for individuals who need more time to file their tax returns. While anyone can request an extension, certain situations might make it urgent or beneficial to do so. If you find yourself in one of these situations, be sure to submit Form 4868 as soon as possible to avoid penalties and interest. Fill Now

Tax Form 4868 Example Are you one of those people who always wait until the last minute to file your taxes? Do you need more time to prepare your tax return? If so, then the tax form 4868 might be your best friend. In this article, we will discuss what Form 4868 is, who needs to file it, and how to file it. Terms to Use IRS Form 4868 Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, is a document that allows individuals to request an automatic extension of time to send their federal income tax returns. The individual will have an additional six months to file their tax return if approved. Form 4868 Target Audience Individuals who cannot submit their tax return by the due date, usually April 15th, can request an extension by filing federal form 4868. However, it is important to note that an extension of time to file does not extend the time to pay any taxes owed. Individuals must still estimate and pay any taxes owed by the original due date to avoid penalties and interest. Form 4868 Examples & Solutions While anyone can request an extension of time to send their tax return, certain situations may make it necessary or beneficial to do so. Here are a few examples: Natural disasters: If you live in an area that has been declared a federal disaster area, you may be eligible for an extension of time to file your tax return. For example, if you were affected by Hurricane Ida and live in one of the designated disaster areas, you may have until January 3, 2022, to send your tax return. Military service: If you are a military member serving in a combat zone, you may be eligible for a time extension to submit your declaration. You may have up to 180 days after you leave the combat zone to send your tax return and pay any taxes owed. Nonresident alien: If you are a nonresident alien who does not have a green card and do not meet the substantial presence test, you may need to file form 4868 to request an extension of time to submit your yearly declaration. This will give you an additional six months to meet the substantial presence test and file your annual declaration. File Federal Form 4868 Example Filing the document is relatively simple. You can file it electronically using tax software or through the IRS's Free File program. Alternatively, you can send a paper form by mail. If you are expecting a refund, there is no need to send form 4868, as the extension only applies to the time to file, not the time to receive a refund. Form 4868 can be a valuable tool for individuals who need more time to file their tax returns. While anyone can request an extension, certain situations might make it urgent or beneficial to do so. If you find yourself in one of these situations, be sure to submit Form 4868 as soon as possible to avoid penalties and interest. Fill Now -

![image]() 4868 Tax Form: Printable PDF Filing taxes can be a stressful experience, especially if you need more time to prepare all the necessary documents. Fortunately, the IRS offers an extension of up to six months to file your tax return, which can be requested by filling out Form 4868. In this article, we will guide you through obtaining and completing the printable blank PDF of Form 4868, filing it correctly, and meeting the due date. Printable Blank Form 4868 PDF The easiest way to obtain the printable blank PDF of the 4868 sample is to visit the official IRS website and download it from there. Alternatively, you can use a third-party tax preparation software that includes the application as part of its services. Once you have the template, you can print it out and fill it in by hand, or use a PDF editor to complete it digitally. Rules to Fill in the 4886 Form Appropriately Enter your personal information accurately, including your name, address, and Social Security number. Estimate your tax liability and make sure that you pay at least 90% of it by the original due date of your tax return. Indicate the type of tax return you are filing for, such as individual, partnership, or corporation. If you are out of the country, write "out of the country" on the template's address field. Sign and date the document before submitting it. File the Printable 4868 Form Correctly Mail the completed Form 4868 to the appropriate IRS address by the due date (see below for details). Alternatively, you can file the PDF electronically by using IRS e-file or a tax preparation software that supports e-filing. Pay any estimated taxes owed by the original due date to avoid penalties and interest. Due Date The due date for filing Federal Form 4868 is the same as your tax return's original due date, typically April 15th for individual taxpayers. If the due date falls on a weekend or a holiday, the deadline is extended to the next business day. For tax year 2021, the due date has been extended to May 17th, 2021, due to the ongoing COVID-19 pandemic. In conclusion, filing IRS Form 4868 can be a helpful tool for taxpayers who need more time to prepare their tax return. By following the guidelines outlined in this article, obtaining and completing the printable blank PDF of Form 4868 can be done with ease, allowing you to meet the deadline and avoid unnecessary penalties and interest. Fill Now

4868 Tax Form: Printable PDF Filing taxes can be a stressful experience, especially if you need more time to prepare all the necessary documents. Fortunately, the IRS offers an extension of up to six months to file your tax return, which can be requested by filling out Form 4868. In this article, we will guide you through obtaining and completing the printable blank PDF of Form 4868, filing it correctly, and meeting the due date. Printable Blank Form 4868 PDF The easiest way to obtain the printable blank PDF of the 4868 sample is to visit the official IRS website and download it from there. Alternatively, you can use a third-party tax preparation software that includes the application as part of its services. Once you have the template, you can print it out and fill it in by hand, or use a PDF editor to complete it digitally. Rules to Fill in the 4886 Form Appropriately Enter your personal information accurately, including your name, address, and Social Security number. Estimate your tax liability and make sure that you pay at least 90% of it by the original due date of your tax return. Indicate the type of tax return you are filing for, such as individual, partnership, or corporation. If you are out of the country, write "out of the country" on the template's address field. Sign and date the document before submitting it. File the Printable 4868 Form Correctly Mail the completed Form 4868 to the appropriate IRS address by the due date (see below for details). Alternatively, you can file the PDF electronically by using IRS e-file or a tax preparation software that supports e-filing. Pay any estimated taxes owed by the original due date to avoid penalties and interest. Due Date The due date for filing Federal Form 4868 is the same as your tax return's original due date, typically April 15th for individual taxpayers. If the due date falls on a weekend or a holiday, the deadline is extended to the next business day. For tax year 2021, the due date has been extended to May 17th, 2021, due to the ongoing COVID-19 pandemic. In conclusion, filing IRS Form 4868 can be a helpful tool for taxpayers who need more time to prepare their tax return. By following the guidelines outlined in this article, obtaining and completing the printable blank PDF of Form 4868 can be done with ease, allowing you to meet the deadline and avoid unnecessary penalties and interest. Fill Now -

![image]() Federal 4868 Tax Form As the tax season approaches, many Americans start feeling the stress of meeting the tax deadline. The good news is that you can get an automatic six-month extension to file your federal income declaration using IRS Form 4868. In this essay, we will explore the history of the application, the reasons why you might need it in 2023, any exemptions for using it, and any changes in the template for the 2022-2023 tax season. The History of Tax Form 4868 The Internal Revenue Service (IRS) introduced Form 4868 in 1998, giving taxpayers an option to extend the deadline for filing their federal income tax return by six months. The form is officially called the "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return" and is used by millions of taxpayers every year. Why Use Federal Form 4868 in 2023? If you can't file your federal income tax return by the April 15 deadline, you can request an extension by filing Form 4868. This document will give you an additional six months to file your return, which means that the new deadline will be October 15, 2023. Here are some reasons why you might need to use this application: You need more time to gather all your financial information You are waiting for important documents, such as a Schedule K-1 from a partnership or an S corporation You need more time to file your state income declaration You are traveling outside of the country on the tax deadline Exemptions for Using IRS Form 4868 While many taxpayers can benefit from using Form 4868, there are some exemptions to keep in mind. Here are the exemptions for using this application: You are a member of the military serving in a combat zone or a contingency operation You are a civilian serving in a combat zone or a contingency operation You are a victim of a natural disaster, such as a hurricane or a flood, that makes it impossible for you to file your declaration on time Changes in the Template for 2022-2023 The IRS updates Form 4868 each year, so it's important to use the correct version for the relevant year you are filing. For the 2022-2023 tax season, there are no significant changes to the template of Form 4868. However, it's always a good idea to double-check the form instructions before filling it out to ensure that you are providing accurate information. In conclusion, IRS Form 4868 is a valuable tool for taxpayers who need more time to file their federal income declarations. By submitting this application, you can get an automatic six-month extension until October 15, 2023, to file your return. Just remember to check for any exemptions and to use the correct version of the document for the tax year you are filing. With these tips in mind, you can easily reduce your tax season stress and file your return. Fill Now

Federal 4868 Tax Form As the tax season approaches, many Americans start feeling the stress of meeting the tax deadline. The good news is that you can get an automatic six-month extension to file your federal income declaration using IRS Form 4868. In this essay, we will explore the history of the application, the reasons why you might need it in 2023, any exemptions for using it, and any changes in the template for the 2022-2023 tax season. The History of Tax Form 4868 The Internal Revenue Service (IRS) introduced Form 4868 in 1998, giving taxpayers an option to extend the deadline for filing their federal income tax return by six months. The form is officially called the "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return" and is used by millions of taxpayers every year. Why Use Federal Form 4868 in 2023? If you can't file your federal income tax return by the April 15 deadline, you can request an extension by filing Form 4868. This document will give you an additional six months to file your return, which means that the new deadline will be October 15, 2023. Here are some reasons why you might need to use this application: You need more time to gather all your financial information You are waiting for important documents, such as a Schedule K-1 from a partnership or an S corporation You need more time to file your state income declaration You are traveling outside of the country on the tax deadline Exemptions for Using IRS Form 4868 While many taxpayers can benefit from using Form 4868, there are some exemptions to keep in mind. Here are the exemptions for using this application: You are a member of the military serving in a combat zone or a contingency operation You are a civilian serving in a combat zone or a contingency operation You are a victim of a natural disaster, such as a hurricane or a flood, that makes it impossible for you to file your declaration on time Changes in the Template for 2022-2023 The IRS updates Form 4868 each year, so it's important to use the correct version for the relevant year you are filing. For the 2022-2023 tax season, there are no significant changes to the template of Form 4868. However, it's always a good idea to double-check the form instructions before filling it out to ensure that you are providing accurate information. In conclusion, IRS Form 4868 is a valuable tool for taxpayers who need more time to file their federal income declarations. By submitting this application, you can get an automatic six-month extension until October 15, 2023, to file your return. Just remember to check for any exemptions and to use the correct version of the document for the tax year you are filing. With these tips in mind, you can easily reduce your tax season stress and file your return. Fill Now